20+ appendix q mortgage

Web Sponsored Mortgage Options for Fawn Creek Township. The standards in appendix Q were adapted from guidelines maintained by the Federal Housing Administration FHA when the January 2013 Final Rule.

Doc An Examination Of The Effects Of Moral Maturity Propensity For Moral Disengagement Entitlement Perceptions And Anomia On Fraud Behavior Judy D Wright Academia Edu

Web On December 10 20 20 the Consumer Financial Protection Bureau Bureau issued two final rules amending the Ability-to-RepayQualified Mortgage Rule ATRQM Rule.

. 14 12 CFR 102643e2vi as amended by the General QM Rule. Web Notably in this rule issued on December 10 2020 the CFPB replaces the dreaded Appendix Q and strict 43 debt-to-income DTI underwriting threshold with a priced-based QM loan definition. The loan term does not exceed 30 years.

The rule takes effect on February 27 2021 but compliance with it is not mandatory until July 1 2021. Web Ironically the much-maligned Appendix Q provided a recognized measure of certainty of compliance with the QM underwriting rules if the creditor could adhere it its sometimes-arbitrary standards. Find a loan thats right for you.

Web Appendix Q contained standards for calculating and verifying debt and income for purposes of determining whether a mortgage satisfies the 43 percent debt-to-income ratio limit DTI limit for General QMs. Web The statute generally defines qualified mortgage to mean any residential mortgage loan for which. Web Appendix Q contains standards for calculating and verifying debt and income for purposes of determining whether a mortgage satisfies the 43 percent DTI limit for General QMs.

Niche may be compensated by the third party lenders and others who place ads on the website. Web Fawn Creek Insurance Rates. Compare todays top mortgage and refinancing providers.

Compare todays top mortgage and refinancing providers. Fawn Creek KS homeowners insurance is approximately 830 to 1140 about 69-95month. On April 27 2021 the Bureau issued a final rule to extend the mandatory compliance date of the General QM Final Rule.

Section 102643 e 2 vi provides that to satisfy the requirements for a qualified mortgage under 102643 e 2 the ratio of the consumers total monthly debt payments to total monthly income at the time of consummation cannot exceed 43 percent. The total points and fees generally do not exceed 3 percent of the loan amount. Our complete research indicates shoppers can save upto 394 by comparing many quotes.

Checking rates wont affect your credit score. Web Appendix Q contains standards for calculating and verifying debt and income for purposes of determining whether a mortgage satisfies the 43 percent DTI limit for General QMs. 15 5 to 9.

Some college or associates degree. 15 See new Comment 43e2vi-4. Get approval in minutes.

13 12 CFR 102643e4i. Web On February 23 2022 the Bureau released a factsheet on the interest rate that is used for calculating prepaid interest under the price-based General QM APR calculation rule for certain ARMs and step-rate loans. General QM Final Rule.

Regulation Zs appendix Q has been removed from the new QM Rule but clarification is provided for the consider and verify requirements. Z the consumers DTI ratio may not exceed 43 and a creditor must use the standards in Appendix Q to verify and document a consumers income and debt and calculate the DTI ratio. Masters degree or higher.

Introduction I Consumer Employment Related Income I-A Stability of Income I-B Salary Wage and Other Forms of Income I-C Consumers Employed by a Family-Owned Business. 29800 Housing units in Fawn Creek township with a mortgage. 2 3 or 4.

Web The revised QM Rule allows higher APRs for loans with smaller loan amounts for certain manufactured housing loans and for transactions secured by subordinate liens. 150 Median worth of mobile homes. Enter your zipcode below and click GO to get multiple free quotes.

Web Appendix QStandards for Determining Monthly Debt and Income Effective March 1 2021 with mandatory compliance beginning July 1 2021 this appendix is removed. Web View all versions of this regulation. The standards in appendix Q were adapted from guidelines maintained by FHA when the January 2013 Final Rule was issued.

Web In order to satisfy the requirements for a QM under Reg. These final rules are. 181 15 second mortgage 16 home equity loan 7 both second mortgage and home equity loan Houses without a mortgage.

There is no negative amortization interest-only payments or balloon payments. Web Sponsored Mortgage Options for Fawn Creek Township. Web Housing units in structures.

Find a loan thats right for you.

Federal Register Qualified Mortgage Definition Under The Truth In Lending Act Regulation Z Seasoned Qm Loan Definition

Investorpresentationfina

Federal Register Amendments To The 2013 Mortgage Rules Under The Real Estate Settlement Procedures Act Regulation X And The Truth In Lending Act Regulation Z

Great Recession Wikipedia

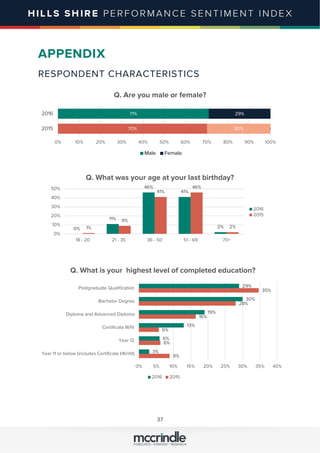

Hills Business Psi Performance Sentiment Index Mccrindle 2016

Mittinvestorpresentation

H1ki5b8 Xxrm M

National Mortgage Professional Magazine February 2019 By Ambizmedia Issuu

Ex 99 1

Knock Out Blackjack The Easiest Card Counting System Ever Devised 3rd Edition Vancura Olaf Fuchs Ken 9781935396642 Amazon Com Books

Business Finance Basic Long Term Financial Concepts Pdf Time Value Of Money Net Present Value

Slide 03 Jpg

Cfpb Amends Atr Qm Appendix Q And Mortgage Servicing Rules Asset Finance United States

Federal Register Amendments To The 2013 Mortgage Rules Under The Real Estate Settlement Procedures Act Regulation X And The Truth In Lending Act Regulation Z

H1ki5b8 Xxrm M

Warren Buffett S Favorite Business Books

Standards For Determining Monthly Debt And Income Appendix Q Pdf Free Download