30+ mortgage reserve requirements

Web Reserve requirements will vary from bank to bank and from mortgage program to mortgage program but you can get a good idea of what you may need to provide for different. The application for property B requires reserves of 10000.

Daily Mortgage Report April 30 Ratespy Com

Though credit score loan to value LTV and property type.

. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Web Minimum reserves apply to DU loan casefiles with DTI ratios exceeding 45. Thats why its good business to have a sound reserve account at all.

Web The application for property A requires reserves of 5000. Ad Calculate Your Payment with 0 Down. Turn A Portion Of Your Homes Equity Into Supplemental Cash With A Reverse Mortgage Loan.

Get A Free Information Kit. Web Reserve Requirement Reserve Requirement Ratio Deposit Amount. Web 4 hours agoWhat this means.

Get Instantly Matched With Your Ideal Mortgage Lender. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. See B2-12-03 Cash-Out Refinance Transactions.

A healthy reserve account will help you lower assessments for major projects and mortgage lenders look at this figure closely. High credit scores To qualify for a jumbo. Web With a Jumbo Smart loan the minimum requirement for a 30-year fixed on primary residences vacation homes and investment properties is a 680 median FICO.

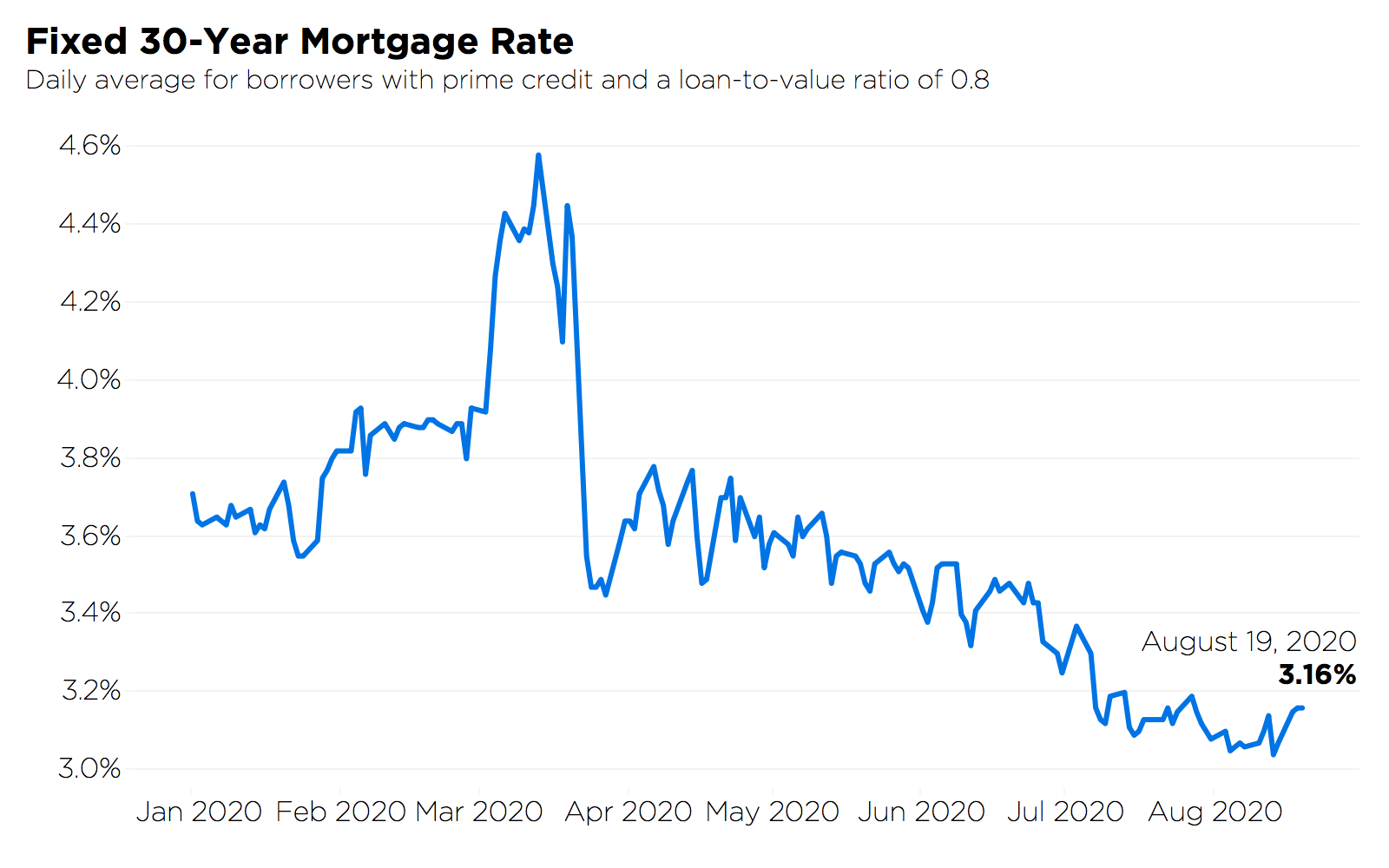

Web FHA Credit Requirements for 2023 FHA Loan applicants must have a minimum FICO score of 580 to qualify for the low down payment advantage which is currently at 35. Turn A Portion Of Your Homes Equity Into Supplemental Cash With A Reverse Mortgage Loan. Rates for a 30-year mortgage fell more than a quarter of a percentage point today bringing this popular repayment term down to its lowest levels in.

Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. Web Learn what mortgage reserve requirements are and why they are necessary. For Homeowners Age 61.

Web Three of the primary requirements for jumbo loans are a high credit score low debt-to-income DTI ratio and good cash reserves. Because the reserves are covering the same. Lower LTVCLTV and HCLTV ratios.

Web These new jumbo requirements serve as an update to news in April that Wells Fargo would only refinance jumbo mortgages for customers with at least 250000 or. At a minimum the reserve plan should cover 20 years unless your state law requires a lengthier period. Web Mortgage rates edged further toward 7 rising for the fifth consecutive week as the Federal Reserve suggests rate increases will continue amid stubborn inflation.

If your monthly housing cost is 1500 then you would need 3000. Ad An Easier To Qualify Reverse Mortgage Alternative. For Homeowners Age 61.

Web If a lender says you need two months of reserves to buy a home you must have 2000. Why do lenders need reservesHow many months reserves are required for a mortgageWh. Ad AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees.

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Web Mortgage reserves are one month of your total mortgage payment. Web Reserve requirements are requirements regarding the amount of cash a bank must hold in reserve against deposits made by customers.

Web The requirement for cash reserves varies depending on the purpose of your loan the type of property youre financing your credit scores debt-to-income DTI. Ad AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees. Ad Compare the Best Reverse Mortgage Lenders.

Tap Into Your Home Equity. This money must be in. Unlock Your Home Equity Without Interest PMI or Monthly Fees.

Web This could be 20 30 or 40 years. Ad Use Our Comparison Site Find Out How to Get Mortgage Pre Qualification In Minutes. Web Asset reserve requirements for a mortgage Requirements vary based on lender and loan program.

Founded in 1909 Mutual of Omaha Is A Financial Partner You Can Trust. Web While a 30-year fixed-rate mortgage is a popular conventional loan you have other options such as a 15-year fixed-rate loan or a 76 ARM 1 to name a few. Compare Now Find The Lowest Rate.

Your mortgage payment is known as PITI principal interest taxes and insurance. For example if a bank has received 100000 in deposits and the reserve requirement ratio is set at.

When Up Means Down What Happened With Mortgage Interest Rates After The Fed S Hike Zillow Research

Mortgage Reserve Requirements When Buying A Home

What Are Mortgage Reserves Learn About Cash Reserve Requirements After Closing On Your Home Loan

50 30 20 Rule For Budgeting Britannica Money

Hard Money Commercial Lenders Facebook

Tm2011676d3 Ex1img042 Jpg

Home Sales Down 5 8 From Year Ago Amid Tight Inventory Increasing Affordability Challenges And Rising Mortgage Rates Wolf Street

Oxuvbrdcz8xsym

Down Payment And Closing Costs Are Not Enough You Need Reserves To Buy A Home Mortgage Rates Mortgage News And Strategy The Mortgage Reports

As Mortgage Rates Hold Near 14 Month Lows What S A Yield Curve Anyway Marketwatch

Mortgage Rates Explained A Complete Guide To Get You Up To Speed Fast

Why Do Some Lenders Require Cash Reserves Mortgage Expert

Nexwest Mortgage Linkedin

Mortgage Rates Are At Record Lows Here S What That Means For You Zillow Group

Mortgage Guidelines On Late Payments In The Past 12 Months

Thepresentationmaterials

Mortgage Refinance Applications Are Collapsing What S The Impact On The Economy Markets Wolf Street